DOCUMENTS

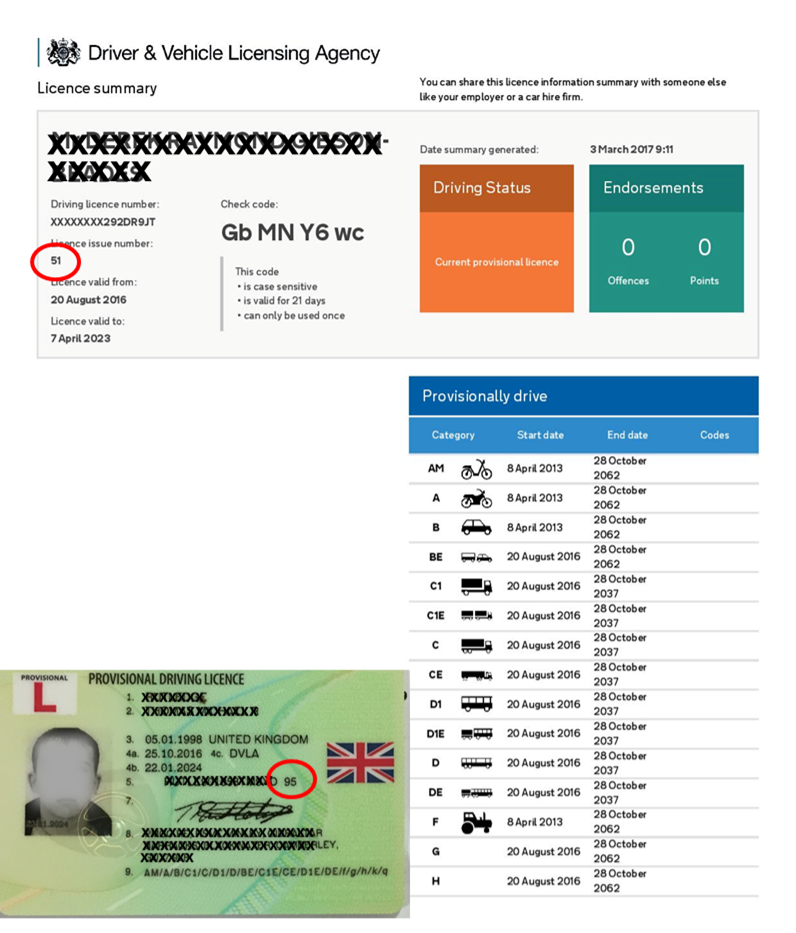

It is very important to make sure that you hold the correct licence for the vehicle you want to drive. Your first licence will be classed as a provisional licence and to apply for this by post you will need form D1. This form is available in any main post office (not all local post offices stock them). When filling the form in, it is important to familiarise yourself with all the categories. If you look at the sample picture you can see below all of the provisional categories the driver can train on are populated.

Driving licences are supplied by the DVSA (Driver and Vehicle Licencing Authority). It is important to include any medical conditions such as deficient eyesight. Failure to declare any medical problems could void any insurance claims, if stopped by the police it could result in prosecution. You can also apply for your licence online. For online applications click on the link below: https://www.gov.uk/apply-first-provisional-driving-licence

When your licence arrives, check it to make sure that you have the right provisional entitlements. It is also important to make sure it is signed. It will be clearly marked PROVISIONAL DRIVING LICENCE and it will also show your details and the licence issue number. The issue number on the licence above is circled in red and must correspond with the information sheet found on View My Licence details on the DVLA website. As you can see this is not a match as the issue numbers are different. This makes the licence illegal and the fault must be rectified. When you are completely satisfied with your licence you can go ahead and book your lessons with a local Advanced Driving Instructor (ADI). The DVLA also provide a list of qualified instructors in your area. Your driving licence has a lifetime and will expire on the date shown under 4b. The licence shown above expires on 22/01/2024. A new photograph must be sent to the DVLA to renew your licence.

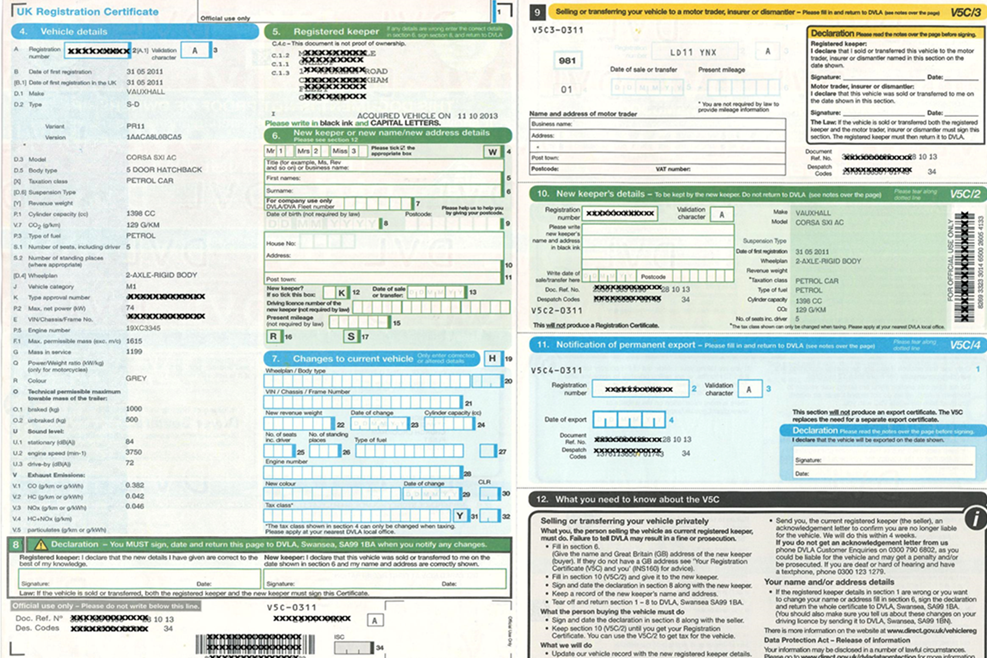

V5C VEHICLE REGISTRATION CERTIFICATE

There are many questions asked about the V5C on the theory test. The V5C is a document that displays all the information concerning your vehicle. This document proves that you are the Registered Keeper of the vehicle and can be one of the required forms that you must produce when stopped by the police. If you do not produce it when stopped, you could be issued with a seven-day producer. You must take it to your local police station and show it to the authority.

The V5C comes in booklet form, it clearly displays the vehicle registration number on the front cover and the address of the registered keeper.

When opened, you will see all the information concerning the vehicle. For the theory test you will need to remember key points as most of you will not own a vehicle at the moment.

If you know someone with a vehicle, ask them if it would be OK to study their document. Look specifically at:

Date of first registration / registration number / registered keeper / previous keeper / make of vehicle / engine size / chassis number / year of manufacture and colour.

Important: if you make any modifications to your vehicle you must notify the DVLA, they will update your V5C and send you a new document. Failure to report them will void your insurance. The V5C will also be used when you come to sell your vehicle, there is a separate section that must be filled in and sent to the DVLA.

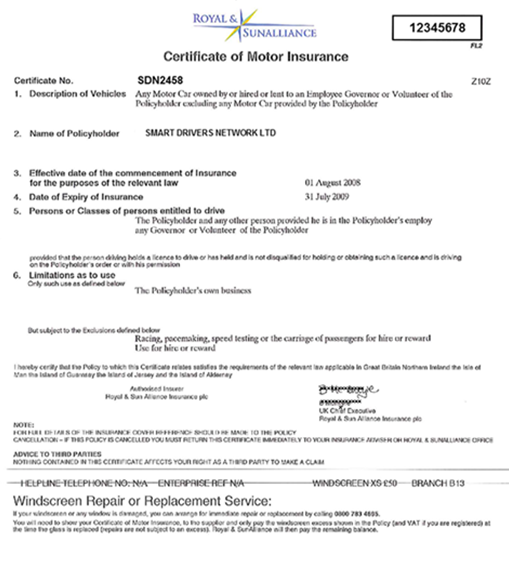

INSURANCE

Now you have purchased your car it is important to make sure that you have the correct insurance cover. Insurance comes in three main categories:

•Third Party

•Third Party Fire and Theft

•Fully Comprehensive

Note: third party is the minimum insurance that you can apply for.

Third Party: Third Party only covers the other vehicle, realistically only choose this option if you are driving a motorised arm chair or if you can afford to write your vehicle off. It only gives cover to third parties and not you. Most insurance companies will not entertain this option.

Third Party Fire and Theft: Third Party Fire and Theft is designed again for the motorised arm chair, the difference in this option is if your upholstery explodes because of internal combustion or you are so unfortunate that someone steals it you are covered. On a more serious note there are many motorists on the road today who are driving without insurance so, you should seriously consider if you can afford to have your vehicle written off and not get a penny for it.

Fully Comprehensive: Comprehensive insurance covers most situations, you can add to the cover extra elements that suit your individual needs. If you can afford it, on your second year it would be advisable to protect your no claims discount. This will not be a great cost to you but it could save you a lot should you be involved in an accident. After the first year providing you have not had any mishaps you will receive a 30% discount, and as each year goes by you will receive an additional discount. Most insurance companies will give a maximum of nine years no claims discount.

It does pay to shop around but if you do find a cheaper quote. If you do change insurance providers after the first year, your new insurers will ask to see a copy of your previous no claims discount. It is important to keep a copy of both the previous insurance and associated paperwork such as the policy schedule.

It does pay to shop around but if you do find a cheaper quote. If you do change insurance providers after the first year, your new insurers will ask to see a copy of your previous no claims discount. It is important to keep a copy of both the previous insurance and associated paperwork such as the policy schedule.

Remember if the documents are online, your access to the documents may be denied once you cancel with the provider so take copies before you change.

Why not add windscreen protection, in most cases windscreens can cost between £300 – £400 pounds and in some cases a lot more. Heated or tinted windscreens are more expensive than standard ones.

A simple stone chip can develop into something more serious rendering your windscreen illegal.

For a small excess payment, you can avoid a colossal bill.

Excess: Excess is the first part of each claim that you are willing to pay. There is now a compulsory minimum excess on nearly all insurance groups of £100. By agreeing to pay a higher excess than this will help to bring down the overall cost of your insurance. (If you agreed to pay £500 excess your insurance will be greatly reduced).

Reducing your insurance costs: If you want to reduce your insurance costs you can take further steps:

1.Have a black box fitted

2.Join a vehicle watch scheme (fit a tracker)

3.Get your windows etched with your registration number (engraved)

4.Get the Aviva smart drivers App

These are just a few examples that will help you. Remember to let your insurance company know if you have taken additional steps to protect your vehicle or have a black box or tracker fitted.

On any insurance quote always read the small print.

If you are caught driving without insurance you could be fined up to £5000 pounds.

MOT CERTIFICATE

The M.O.T (Ministry of Transport Test Certificate) does not apply to all vehicles. If you are fortunate and can afford to buy a brand-new vehicle the manufacturer’s warranty will cover you for the first three years.

Once your vehicle is over three years old you will need to get a MOT. The MOT only lasts for twelve months. Your vehicle will be tested to the highest standard and if it passes your vehicle will be judged to be of the legal standard for the next twelve months. This is however subject to you ensuring you maintain it to this standard. A lot can go wrong during the twelve months and you are obliged by law to keep your vehicle roadworthy whilst using it on public highways.

On any MOT, there are sometimes advisories. These will be tested parts that are currently legal but are close to the legal limit. One of the most common advisory given is tyres that are close to the minimum legal depth. A MOT testing station will not fail your vehicle because of an advisory but it is important to keep a regular check on anything that was identified on the list and be prepared to replace before they make your vehicle illegal to use.

The only time that you can drive your vehicle without a current MOT. If you have made an appointment to get it tested and you are driving it to the appointment.

Not all vehicles on the road require an MOT. Small trailers and caravans are exempt.

VEHICLE EXCISE DUTY

All vehicles come under this law even though now some vehicles are exempt. Road tax is calculated on your vehicle emissions and can vary dramatically. I own a 2-litre diesel car with low emissions but my wife has a 1.2 petrol Corsa, it might surprise you to know that my road tax is £30 per annum but my wife’s is £140.

You can pay for your road tax by direct debit. All you need to do is apply online when you receive your reminder. You do have the added option to pay monthly if you renew online which is very useful if you have a tight budget.

You can pay at your local post office, you will need to take the documents that are stated on your reminder. Usually it will be your insurance certificate and MOT if your vehicle is more than three years old.

You can pay for six or twelve months depending on your financial situation if you pay at the post office. It does however always works out cheaper to pay for twelve months.

You used to have to display your tax certificate on your vehicle but this has now ceased, all your vehicles details are stored online and are accessible by the police at any time.

The certificate shown above is the old tax disc ,would have displayed this on the inside of your windscreen. This certificate is no longer in circulation.